Roth 401 K Contribution Limits 2025 Over 50. That means an active participant 50 or. That's on top of the standard $23,500 limit for.

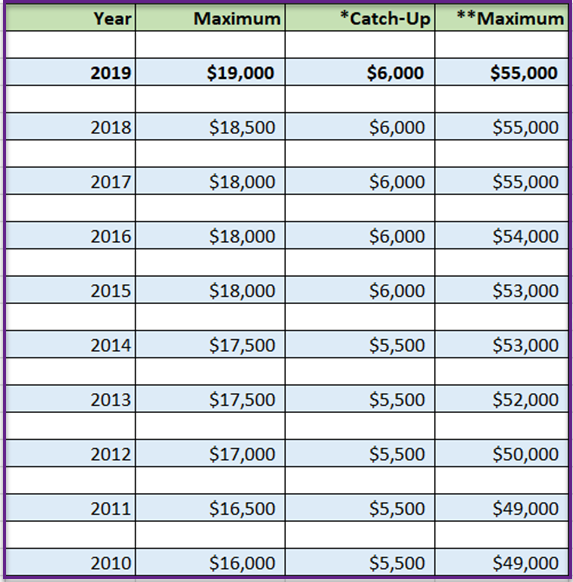

The total employee contribution limit to all 401(k) and 403(b) plans for those under 50 will be going up from $23,000 in 2025 to $23,500 in 2025. The 401(k) contribution limit for employees in 2025 has increased to $23,500, up from $23,000 in 2025.

401k Limit 2025 Elka Martguerita, In 2025, the irs has forecasted an increase in the 401(k) elective deferral limit to $24,000, up by $1,000 from the current limit.

2025 401k Roth Contribution Limits 2025 Isaac Gray, That's on top of the standard $23,500 limit for.

Ira Contribution Age Limit 2025 Dela Monika, The employer contribution limit also rises to $46,500, bringing the.

Maximum Roth 401k Contribution 2025 Over 55 Tobe Adriena, In 2025, secure 2.0 adds a higher catch.

SelfDirected Roth Solo 401k Contribution Limits for 2025 My Solo, Additionally, the total contribution limit for defined.

PPT Roth 401(k) PowerPoint Presentation, free download ID5387350, The 401k contribution limits for the year 2025 are expected to see many increases in different plans including elective deferral limit to $24,000, defined contribution.

Infographics IRS Announces Revised Contribution Limits for 401(k), In 2025, the irs has forecasted an increase in the 401(k) elective deferral limit to $24,000, up by $1,000 from the current limit.

2025 401(k) Contribution Limits A Comprehensive Guide Beginning Of, The roth 401(k) contribution limit for 2025 is $23,500 for employee contributions and $70,000 for employee and employer contributions combined.

Roth 401k Contribution Limits 2025 Over 50 Audie Candida, However, investors age 60 to 63 can save $11,250.

Roth Ira Contribution Limits 2025 And 2025 Toyota Rana Ursula, In 2025, the irs has forecasted an increase in the 401(k) elective deferral limit to $24,000, up by $1,000 from the current limit.

Guide_SNEAK.png)